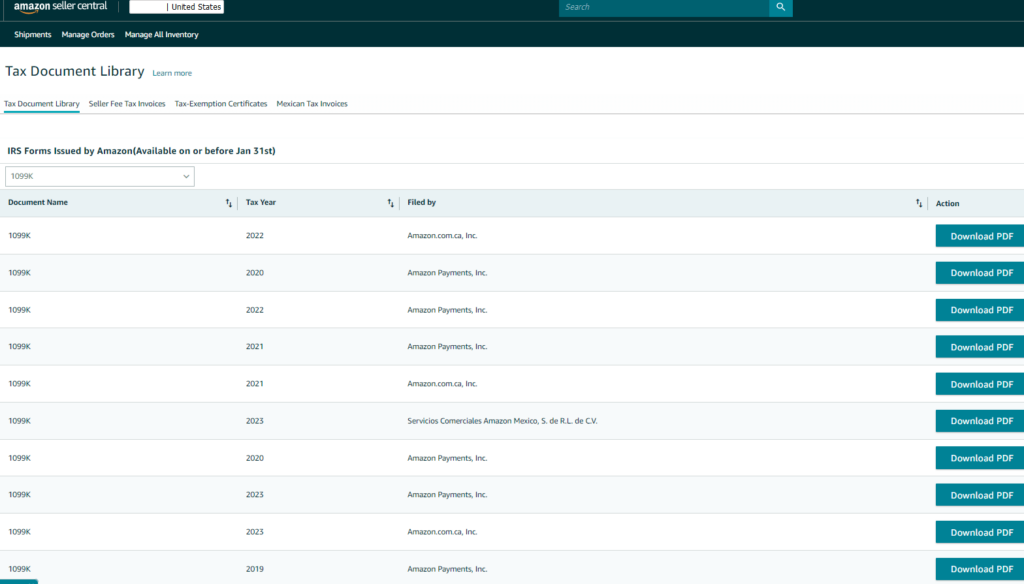

Your 1099-K form from Amazon Seller is now available for download. We will show you how to access it:

- Sign in at https://sellercentral.amazon.com/gp/tax/tax-library.html

- Go to the Reports tab.

- Click on Tax Document Library.

- Choose the year you need.

- Download your forms.

Remember, electronic delivery is our standard method for sending tax forms. If you’ve opted for a physical copy by mail, thereafter, it will be sent to your latest address on file. For any tax-related queries, please consult your tax advisor.

Important Information: The IRS mandates Amazon to annually file Form 1099-K to detail the total gross amount of all eligible payment transactions. Eligible transactions include payment card or third-party network transactions.

You’ll receive this form if, in the 2023 calendar year, you exceeded $20,000 in gross sales and had more than 200 transactions in sold inventory., were subject to withholding, or reside in a state with a lower reporting threshold.

What other tax documents you will receive from Amazon Seller Central for 2023?

As an Amazon Seller, besides the 1099-K form, you will receive other tax documents depending on various factors. Those factors are your business structure, location, and specific transactions. Here are some potential documents you might receive for the year 2023:

- Form 1099-MISC: This form is used to report miscellaneous income. If you receive payments from Amazon that are not related to sales transactions, such as referral fees, promotional rebates, or other non-sale activities, as a result they may be reported on this form.

- Form 1042-S: For non-U.S. sellers, Amazon might issue Form 1042-S. This is the report for income that is considered to be effectively connected with a U.S. trade or business. This is particularly relevant if you are a non-U.S. resident and have elected to treat your income as effectively connected with a U.S. business.

- State-Specific Tax Documents: Depending on the state where you operate, as a consequence, there may be specific state tax documents required. Some states have distinct reporting requirements. Amazon will provide relevant documents as per state laws.

- VAT Invoices or Reports: If you are selling in regions where Value Added Tax (VAT) is applicable (like the European Union or the United Kingdom), Amazon might provide you with VAT invoices or reports that detail the VAT collected on your sales.

Bookkeepers and Accountants

It’s important to remember that the exact tax documents you’ll receive can vary based on your individual circumstances and changes in tax laws. As you focus on sales throughout the whole year, taxes are important, too! Make sure you have a good bookkeeper to record all transactions daily. As a result that will help you at the end of the year.

Always consult with a tax professional to understand your specific tax obligations. They will guide you on the documents you need to fulfill. You usually talk to your accountant once a year. Keep all books updated, which will eventually make your life easier during Q1 of each year.