Last updated on September 9th, 2021 at 01:49 pm

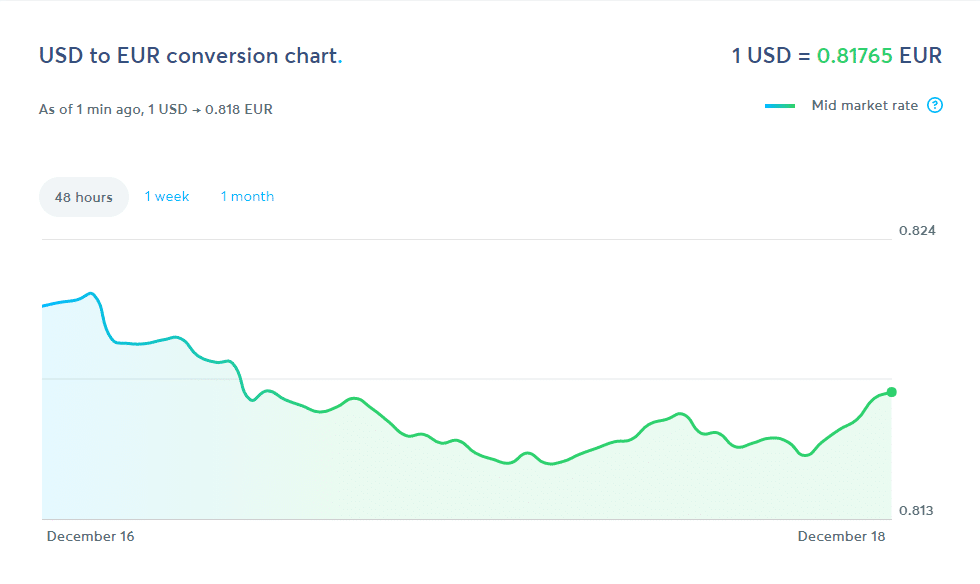

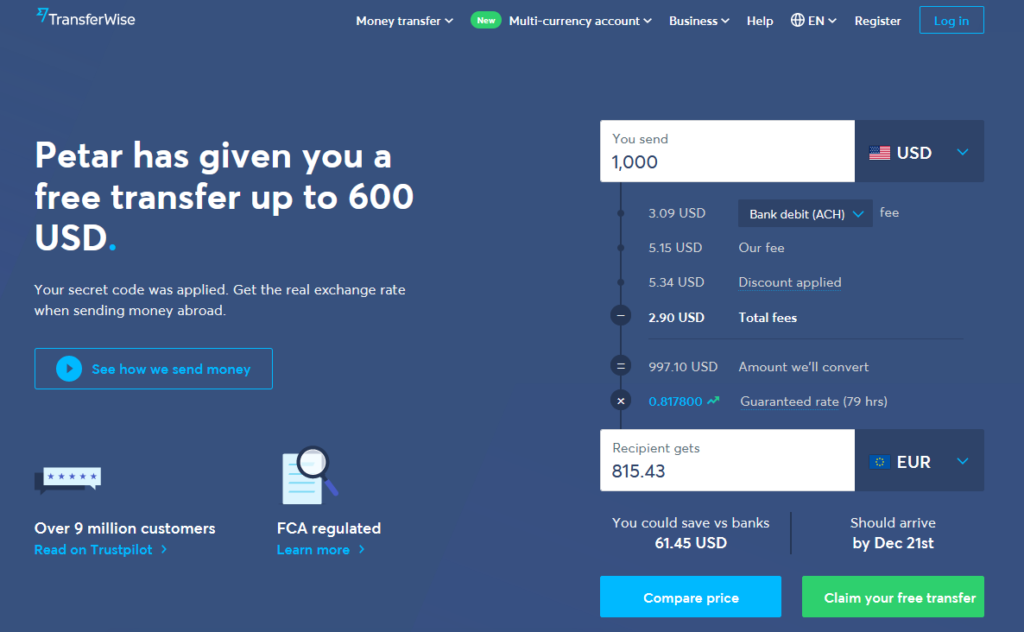

- Always transfer USD to EUR, so we get the market exchange rate of TransferWise, which is REAL time and ALWAYS the best.

- If you transfer USD to USD, then the receiving bank will use their own exchange rate. In most cases, it is way below market. In addition, if the receiving bank receives the funds in foreign currency, they usually charge additional 0.1% conversion rate. By using TransferWise, GAIN will be in both exchange rate + avoiding the conversion rate of the recipient’s bank.

- To make it better, you can schedule transfer, DO NOT CONFIRM, and from that point, you will have about 36 hours (it changes based on currency/country) to CONFIRM the transfer. In case, the foreign exchange rate gets better, you can cancel that pending transfer, and create new one. The new one will have better rate. You can check real time TransferWise exchange rate here >>

- To save on ACH fee, we can set some of the revenue to go directly in the company’s TransferWise account. It is treated as regular account, and has amazing Quickbooks app connection. The Quickbooks app is FREE and provided directly by TransferWise, so there will be less issues (if provided by 3rd party Intuit Quickbooks app developer)

Still don’t have TransferWise account? 👉 Sign up here and GET FREE Transfers🎁

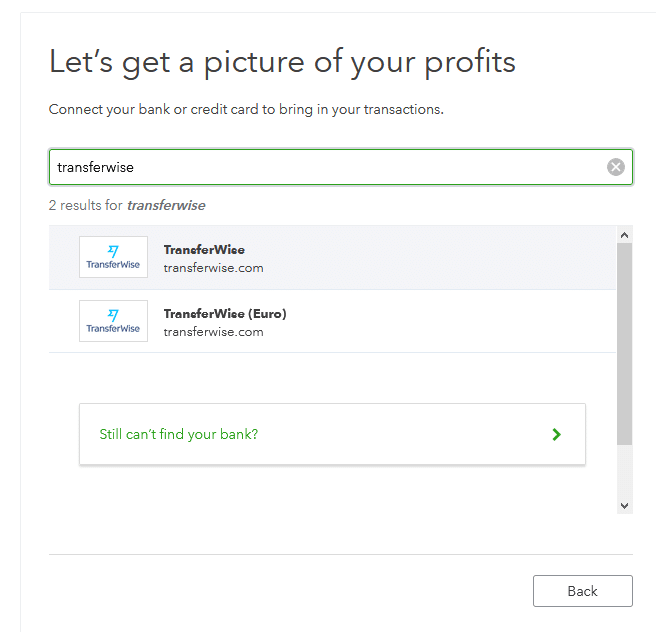

TransferWise connects great with Quickbooks in case you need to manage multiple bank accounts. For example, if you have USD and EURO balances in Quickbooks and want to sync with QB. Go to Quickbooks >> Banking >> Link Account >> Search for Transfewise. Add 1 by 1 for both USD and EURO accounts. It is much easier and better the PayPal Quickbooks integration for example.

4. If you keep a balance over 15000 euros in TransferWise, you will be charged a fee for all balances over 15000 euro.

They charge an annual fee of 0.4% on any EUR you hold above this amount.

TransferWise will wait 3 days before start charging the fee — this means they’ll start charging you on September 12 for example, if you went over your balance on September 9.

The fee is calculated daily based on the amount of EUR you hold above your free allowance. They will take the fee from your account at the end of each month.

As an example — this means that for every 1,000 EUR you hold above your free allowance, you’ll pay about 0.33 EUR a month.