Last updated on August 31st, 2023 at 12:52 pm

On Thursday, August 24, 2023, (AMC) – AMC Entertainment Holding Inc. is scheduled to perform a 1 for 10 reverse split. All AMC holders will be impacted if they hold AMC up to August 23, 2023 at 8 PM ET.

Details on what will happen with AMC Stock Reverse Split:

- At the start of the pre-market hours, 7:00 AM eastern time on August 24, 2023, the number of shares customers hold will decrease by 10x, and the price per share will increase by 10x.

- Since the decrease in shares equals the increase in price, the collective value of AMC shares will remain the same.

For example, if you own 10 shares of AMC worth $25.00 on August 25, 2023, after the split you’ll own 1 AMC share of AMC worth $25.00 per share—so your total equity in AMC won’t change.

AMC also plans to complete a stock dividend payable on August 28, 2023. Shareholders will receive 0.1333333333 additional shares for every share held as of August 24, 2023. The eligible shares are based on your post split position.

The split is a corporate decision and action decided by the AMC Holding company, and broker houses/brokers were not involved in the decision. If you need to learn more about the details why AMC Entertainment Holding Inc. has decided to perform a stock split, visit the AMC investor relations page.

We will follow how the AMC stock reverse split will unfold

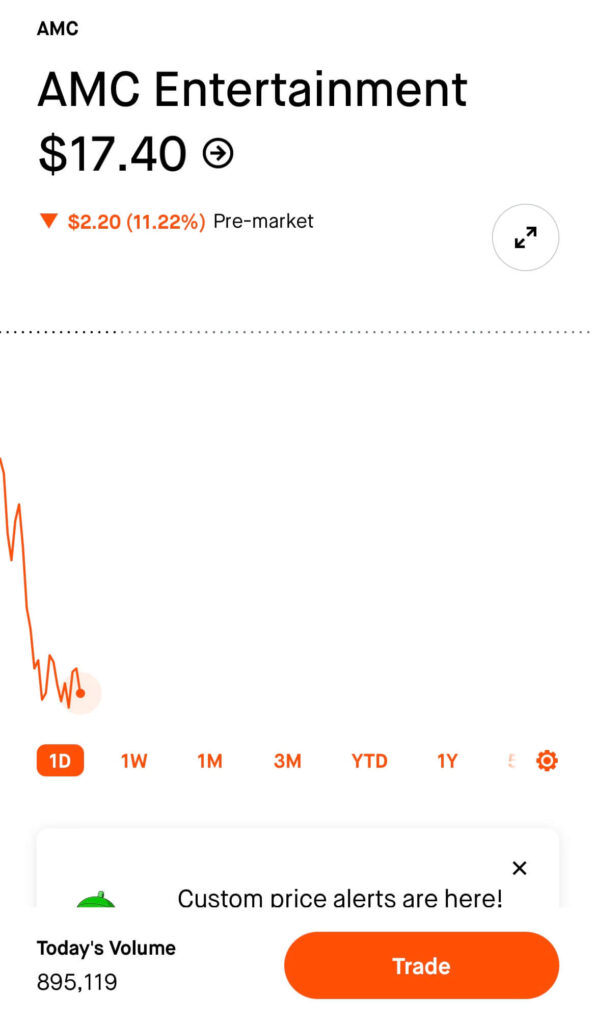

- 8:45 AM, before market opens, AMC price is 11.22% down

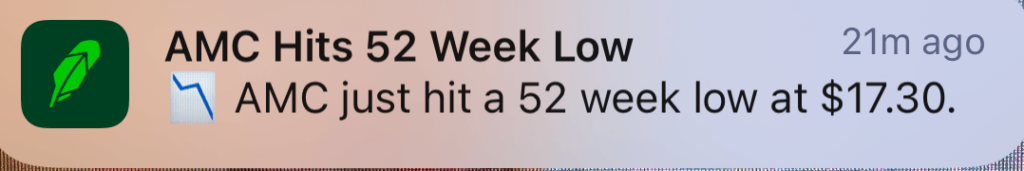

2. 9:25 AM – AMC hits 52 week low:

3. 9.29 AM, just before the market opens, down 17.81%

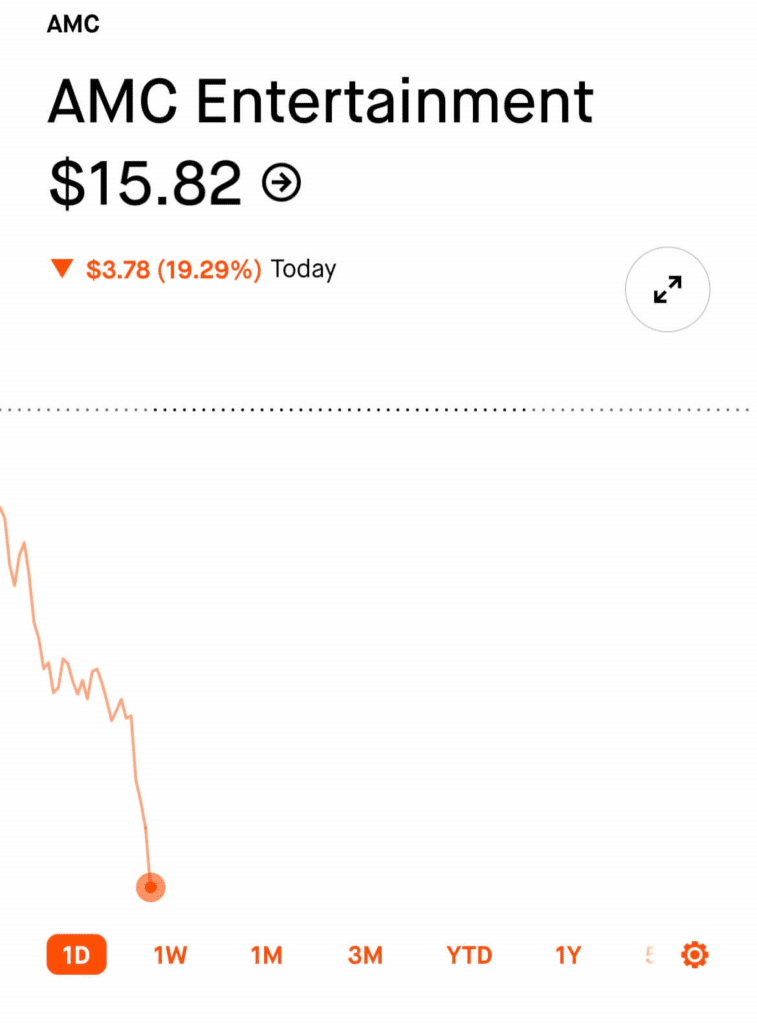

3. 9:34 AM, just a few a minutes after market opened 19.29%, going down even more…

4. 9.55 AM, still goes down after the reverse stock split. AMC is plunging to $14.09.

5. AMC stock still down midday at 1.55 PM, still at $14.09. No move for several hours.

6. August 25, 2023, AMC stock has a strange pick before trading hours. Reaching $196, about 900% up!

7. August 20, 2023, after about a week of no action, AMC stock is flying up. Midday 23.79% up, $13.51

8. But still, after week, the AMC stock is still down 7.15% after the reverse split on August 24, 2023.

What is a stock split?

The process of stocks split is a corporate action in which one company divides the existing outstanding shares into multiple shares units. This essentially increases the number of shares outstanding while proportionally decreasing the price of each individual share. Stock splits do not impact the overall value of an investor’s holdings in the company; they merely adjust the number of shares and their price.

Stock splits are typically expressed as a ratio, such as 2-for-1, 3-for-2, etc. In a 2-for-1 stock split, for example, for every existing share an investor owns, they will receive two new shares. The share price would then be halved to reflect the split.

Stock splits are often carried out by companies to achieve various goals:

- Liquidity and Accessibility: Lowering the share price can make the stock more affordable to a broader range of investors, potentially increasing demand and trading activity.

- Perception of Affordability: A lower share price might make the stock appear more affordable and attractive to individual retail investors.

- Marketability: A stock split can generate publicity and interest in the company, attracting new investors.

- Options and Derivatives: Lowering the share price can make the stock more suitable for options trading and other derivative instruments.

- Psychological Impact: Companies may use stock splits to signal confidence in their future prospects or to boost investor confidence.

It’s important to note that while stock splits adjust the number of shares and their price, they don’t change the fundamental value of the company or an investor’s ownership stake. For example, if you owned 10 shares of a company valued at $100 per share before a 2-for-1 split, you would then own 20 shares valued at $50 per share after the split.

Investors should also be aware that stock splits can result in changes to the company’s market capitalization, earnings per share (EPS), and other financial metrics, which might affect how the market perceives the company’s valuation.

Follows us for more info @ https://www.facebook.com/likecoolstuff