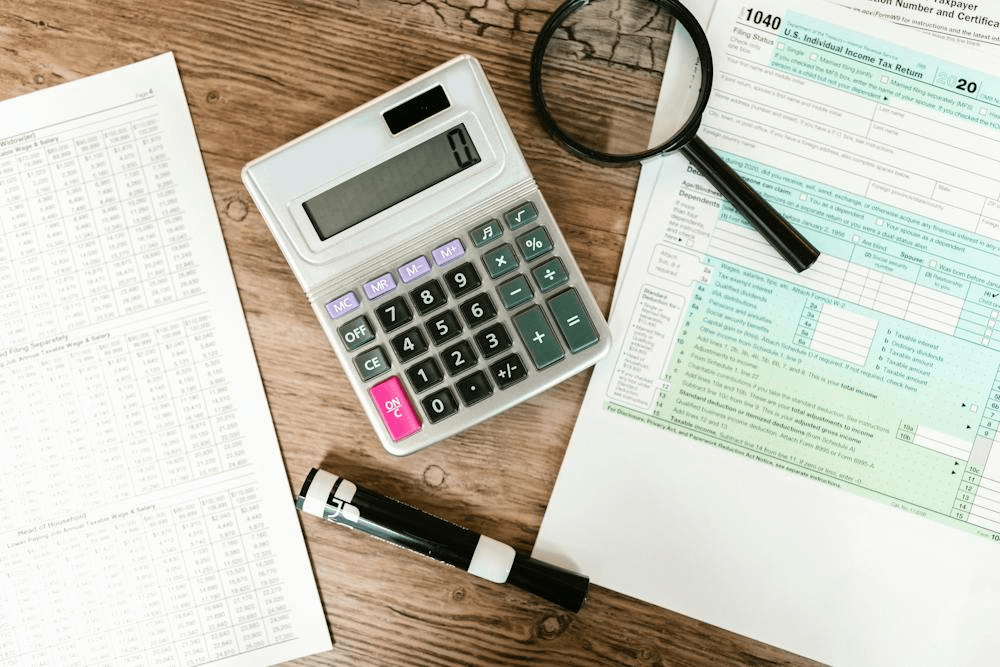

The newly proposed 2024 tax legislation by Congress emphasizes several crucial provisions, significantly impacting tax planning and potential savings. Stay informed as we explore the latest developments surrounding the Tax Relief for American Families and Workers Act of 2024.

Foremost among these are the extension of 100% bonus depreciation and a revision in the Internal Revenue Code (IRC) §174, concerning the R&D Credit amortization. These elements play a pivotal role in tax strategies.

The extension of 100% bonus depreciation allows businesses to immediately deduct the full cost of qualifying property or assets, providing a significant tax benefit. Similarly, the revision in IRC §174 aims to streamline the Research and Development (R&D) Tax Credit by allowing businesses to amortize certain R&D expenses, thus promoting innovation and investment in research and development activities.

As the bill is still in the process of being finalized, it’s important for taxpayers and tax professionals to stay updated with its final form. The proposed tax legislation has the potential to impact various aspects of tax planning, including deductions, credits, and compliance requirements. By staying informed about the latest developments and understanding how these provisions may affect their tax strategies. Consequently, individuals and businesses can effectively navigate the changing tax landscape and maximize their tax savings opportunities.

Key Aspects of the Proposed Legislation

In this section, we delve into the critical components of the proposed legislation, shedding light on key provisions and their potential impact on tax planning and savings. Stay informed as we explore the latest developments and insights surrounding the Tax Relief for American Families and Workers Act of 2024.

Expanded Child Tax Credit:

- Incremental increase of the maximum refundable Child Tax Credit: $1,800 (2023), $1,900 (2024), and $2,000 (2025).

- Modification of the refundable credit, calculated on a per-child basis.

Business Tax Concessions:

- Postponement until 2026 for several tax measures, including the 100% bonus depreciation, IRC §174 research expense amortization, and alterations to the business interest expense limitation.

- Enhancement of the IRC §179 Current Expense deduction limit to $1.29 million and the investment cap to $3.22 million for assets acquired in 2024.

Employee Retention Credit (ERC) Adjustments:

- Prohibition of new ERC claims post-January 31, 2024, with stringent penalties for non-compliance.

- Six-year extension of the statute of limitations for specific ERC claims.

Modifications in Form 1099 Reporting:

- Raised threshold for filing Form 1099-NEC and 1099-MISC from $600 to $1,000, effective after 2023.

- Implementation of inflation-based adjustments starting in 2024.

Disaster Relief and Exclusions:

- Retroactive exclusions for specific wildfire relief payments and disaster-related personal casualty losses.

- Official acknowledgment of payments to victims of the East Palestine, Ohio, train derailment as qualified disaster relief.

U.S.–Taiwan Cross-Border Investment Provisions:

- Introduction of measures to prevent double taxation on investments between the U.S. and Taiwan.

This comprehensive overview provides a glimpse into the proposed changes and their potential implications. Thus, emphasizing the importance of keeping informed about the final version of the bill. Learn more about the year-end tax planning strategies to cut your bill.